Claas from Helpling on balancing liquidity

Feb 3, 2020, by Gemma Doswell

Online Marketplaces

Liquidity

We sat down with Claas to find out how the Helpling gig economy platform tackled balancing liquidity. Here’s what he told us:

1. Can you give me a brief intro to Helpling?

Sure. Helpling was founded in 2014 in Berlin by Benedikt Franke and Philip Huffman. Right from the beginning, the vision was to have an online marketplace for household-related services. From there, we quickly expanded into several other countries, among those being the UK and Ireland. In 2015, we bought our UK competitor, Hassle.com, and integrated them into our company. We now operate in 10 countries worldwide.

I’m based in the London office, managing the UK and Ireland. The core of our product is that we want to make it as easy as possible for households to find help at home - be it with a cleaner or with other service providers. Right now, our focus in the UK and Ireland is on cleaning services but we’re looking into expanding this eventually. For suppliers, many consider it a good source of extra income and a way to leverage their skills. We offer users the entire toolkit and our app offers everything that suppliers need, enabling them to run their own little or large cleaning businesses.

2. Helpling began focused on multiple verticals, why did the focus change?

Our mission has always been to bring our product across all household services and to be with the customer throughout the entire journey, but we decided to focus on one vertical at a time. For the time being, this is cleaning.

In the future, we want to be able to offer our users the opportunity to have their home cleaned, their furniture assembled, their garden kept etc. Likewise, for providers who have a wide range of skills that they want to offer, we will be able to give them the option to upsell their services from cleaning to building and more.

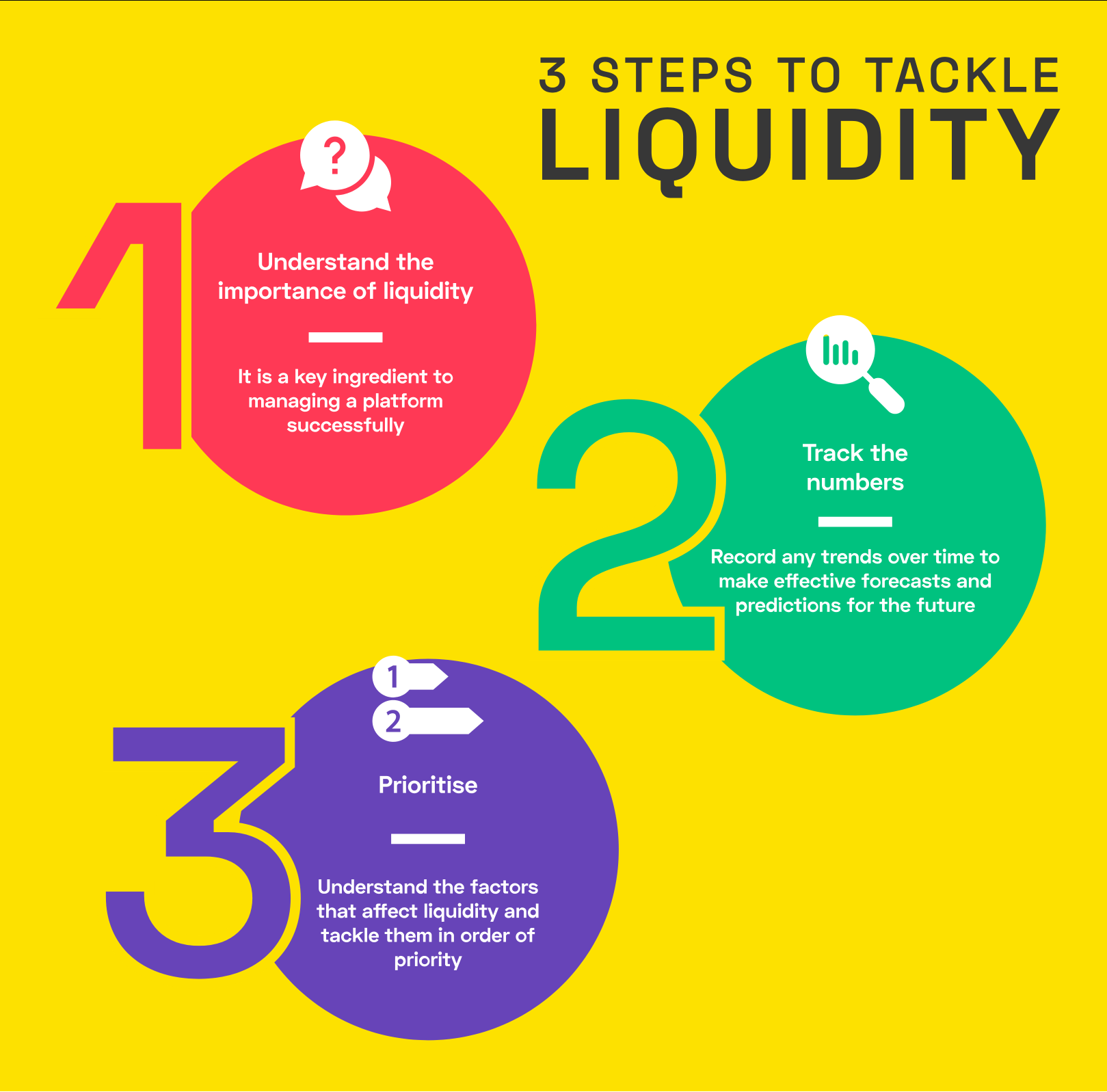

3. How did Helpling tackle the problem of liquidity?

Our marketplace is used by two sides - the supply as well as the demand side come to our platform because they expect to find a matching counterpart. We at Helpling see the challenge of managing liquidity as an inherent part of our business model. Thus balancing supply and demand is one of the things that drives us every day.

We focused on markets with pre-existing liquidity. We knew that the demand was a bit easier to generate so we started with onboarding the supply side. We gained a lot of insights into the market: we knew the levels of both supply and demand that we needed to be able to make a profit. Most of the people involved in our marketing department had different targets around this - and this is how we managed it in the end.

4. How do you tackle leakage?

I think that it’s always a challenge but we generate a lot of value throughout the customer life cycle and this is what we’re putting out there. In everything that we offer, we believe that there’s a strong connection between the supplier, the customer and us as an intermediary. Of course, we create a big chunk of the value when we connect these two parties, but down the line, our value is generated from our app (where both parties can communicate), insurance, customer support services as well as payment services. Maybe the cleaner is sick and needs a replacement, they can only do that if they’re an active customer. Our users can only benefit from all these things if they’re on the platform. If you take it offline, this goes away.

5. In your opinion what were the three biggest challenges to overcome to achieve liquidity?

6. What is the importance of geography/geographical data in liquidity?

That’s key. What we definitely see is that every city and market that we operate in is different. Even within London, South London may behave differently to West London, for example. This is all part of managing liquidity - it’s looking into these things. After all, this model is built on trust and what brings in trust is that you know a person comes from the same area as you and lives in a similar community. People living in Manchester cannot get down to London to clean so there’s only so much that we can do to move demand or supply with geography.

7. Have you found in big cities that you’re more successful on both sides of the market than in smaller ones?

In the bigger cities, we definitely see higher liquidity. The numbers are higher which means that the chances of finding the perfect fit is higher. The more requirements you have on both sides, the more complex it gets. It’s just a numbers game in the end. If you go to a bigger store, the chances are statistically higher that you find what you are looking for. The logic is the same with marketplaces.

8. You talked about focusing on suppliers when Helpling launched. Can you expand on the thinking behind this strategy?

As with most of the marketplaces it’s a bit of a chicken/egg problem. You have the demand and the supply side and need to start with either one of them. If you have a lot of customers that are looking for cleaners but no cleaners looking for customers, your marketplace won’t work. Vice versa, it also doesn’t work. However, we believe that we can generate a customer network faster than we can for the cleaners. For the customers essentially, they can book a cleaner within 60 seconds on our website and this is it. The process is done. On the cleaner’s side, you need to find a cleaner, they go through the different steps and they can’t start finding customers until they are active on the platform. That process definitely takes longer than 60 seconds and this is why we decided to start on that side.

9. Finally, what is most important for a business to focus on to achieve liquidity?

The first thing they need is to define what they want to start with. Is it the supply or the demand side? Once this is determined, a business should focus on it and manage it effectively. By this I mean ensure that they don’t end up with either excess supply or demand.

Then, a business must work to understand what is required to make a profit. This is why it’s always helpful to start with a smaller scale; you don’t have the pressure of needing to convert too many people, and it gives you more time to understand the dynamics behind it.