Coins and tokens - can you spot the difference?

Feb 26, 2020, by Gemma Doswell

Blockchain

Cryptocurrency

Digital Currency

Although the terms are often used interchangeably, crypto coins and crypto tokens are in fact not the same. Both are decentralised and based on blockchain technology, but coins and tokens have different functions. They, therefore, reside in different spaces of the digital finance market.

So what is Bitcoin?

Bitcoin was the first and most popularised cryptocurrency. It is a coin - its function is a store of value and it can be used, similar to fiat money, to pay for things. Like Bitcoin, crypto coins all exist on their own individual blockchains and it is on these that all coin transactions can be recorded. More examples of crypto coins are Litecoin, Monero, Stellar and Namecoin.

The European Central Bank described virtual currencies as “digital money in an unregulated environment, issued and controlled by its developers and used as a payment method among members of a specific virtual community.” As on the Bitcoin blockchain, the exchange of crypto coins is maintained and authorised democratically by the network (or nodes) on each blockchain.

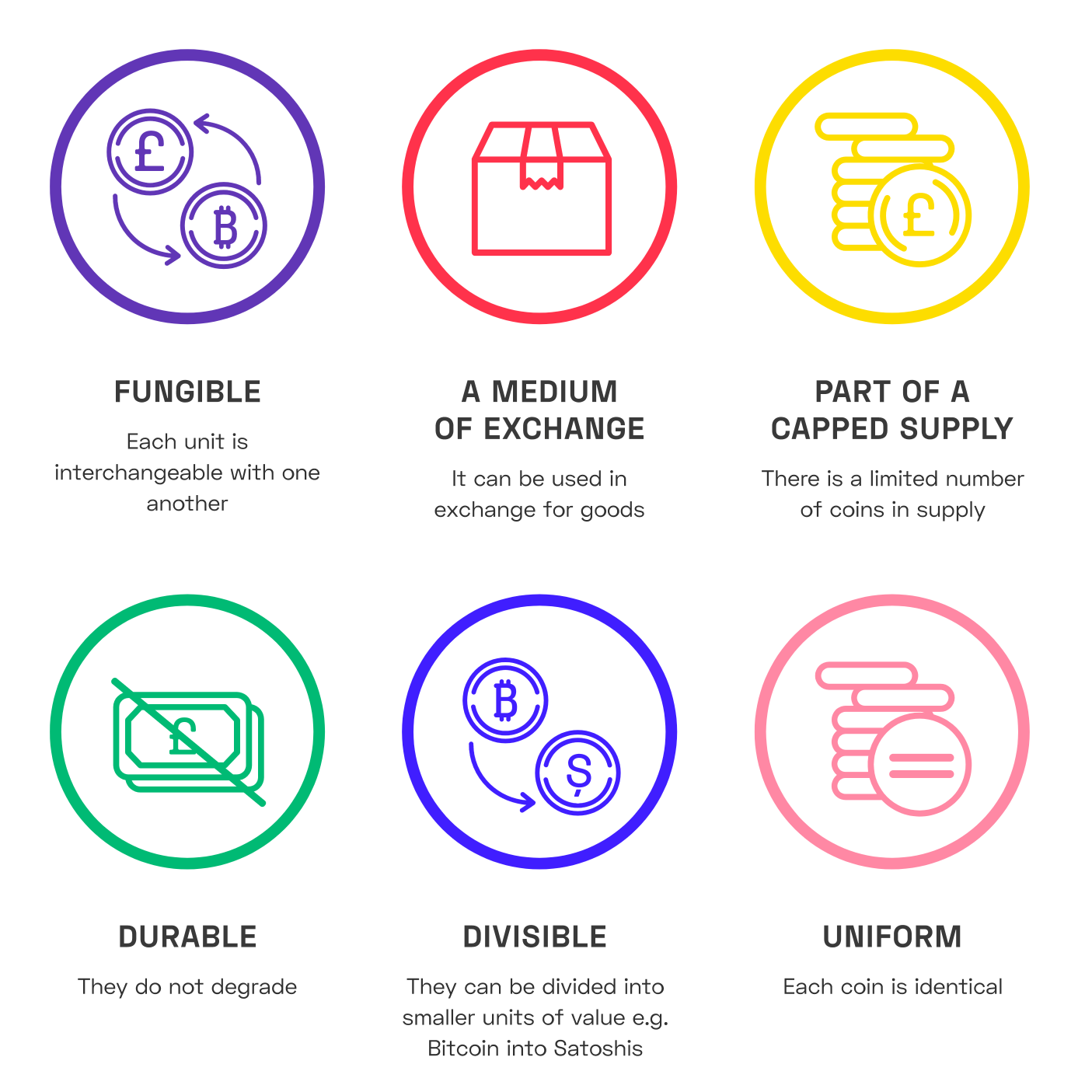

Coins have all of the six following properties:

Why not just use traditional money?

There are copious reasons why people opt to use crypto coins. The most obvious is to attempt to make money. Over the past decade, the value of certain high-profile currencies (namely Bitcoin) has fluctuated so much that the value of one unit has gone from fractions of a penny to over £18,000. But investment in crypto coins is only the start.

Another popular use case is anonymity. Coins like Monero offer near-untraceable, anonymous transactions, boasting resilient security and high levels of privacy - and this has gained it a loyal user-base. Further use cases include security, censorship resistance and international remittances.

What is a token?

A token is more like an asset. In the same way that Virgin air miles can only be used with Virgin, a crypto token sits on a blockchain (or a dApp built on a blockchain) and can only be used to power services within that ecosystem. CoinTelegraph explained, “If it's a fashion startup, one token can be equal to one dress or a yearly license of a software in the case of a hi-tech startup. You even can issue tokens of yourself and a token holder will be able to buy an hour of your work with the token.”

Theoretically, anything in the world can be tokenised. Examples of prominent tokens are Tether, Waves and ERC-20.

Where does that leave Ethereum?

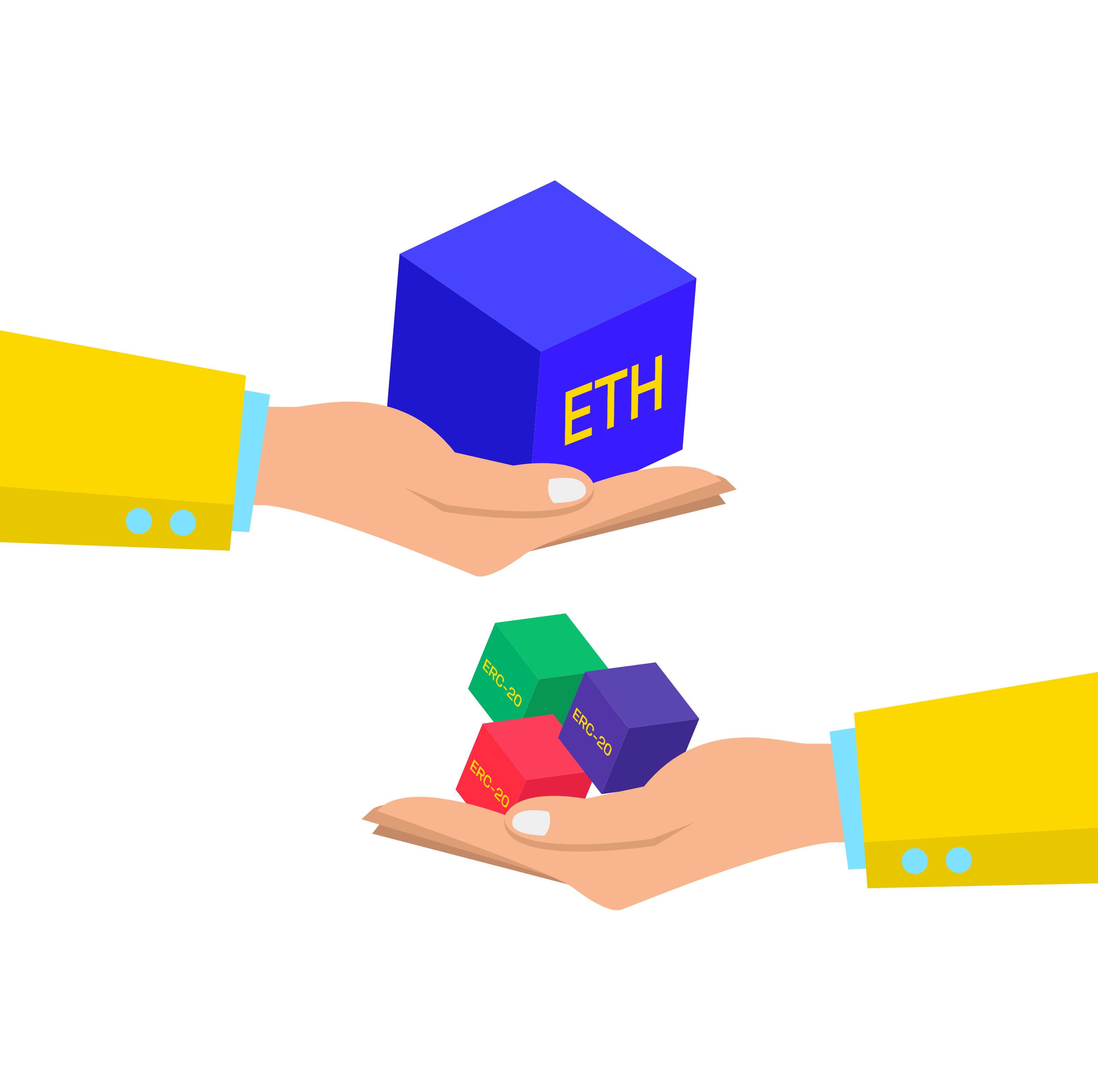

Just to be confusing, the Ethereum blockchain combines both coins and tokens.

It is made up of Ether (ETH) coins and ERC-20 tokens. How could this be? Ether is used to fuel the transactions on the Ethereum blockchain and ERC-20 tokens fuel Ethereum’s main use case.

Using these tokens, the Ethereum blockchain enables developers to build their own decentralised apps. Tokens that are built on the Ethereum blockchain enable developers both to utilise smart contract technology and they also maintain a consistent technical standard for all dApps created.

Want to find out more about the blockchain basics? Take a look at our latest blogs here.