How do payments work for online marketplaces / gig / sharing economy platforms?

Feb 27, 2019, by Dan Whale

Platform Economy

Payments

eMoney

Choosing the right payments option can be the best early decision your business makes

If you are currently setting up your platform and are starting to think about payments, bear in mind, platform payments work differently than payments for more traditional ecommerce businesses.

For traditional ecommerce businesses, the payment flow is simple. Money is transferred from a buyer to a seller using a payment gateway and acquirer. We won’t walk you through the entire ‘four-party model’ (as it is known) now, but if you’re interested in how it works, this article explains it well. This is how online card payments have been made for decades, with the experience becoming sleeker and quicker for the customer in recent years.

But the payment flow of a platform business is different. Platform businesses do not usually sell their own products or services. Instead, they connect buyers and sellers and charge a commission on transactions between them. This means that payments need to be routed. This can be done in one of two ways.

The first method is to use a payment gateway and acquirer as traditional ecommerce businesses do. This entails taking in all payments from your buyers centrally, then calculating your commission, before finally manually transferring the remainder to each individual seller.

This solution is difficult to scale. The more successful your business becomes, the more operational overhead is required to handle payments. Furthermore, if your platform has different fees for different sellers, this becomes even more complex.

Not only this, but as of January 2018 firms acting in this way must become regulated as a financial institution. This is due to the regulatory changes of PSD2, which aim to protect consumers and businesses by only allowing regulated institutions to handle client money.

The second method works differently. By using ‘electronic money’ (eMoney), payments can be split automatically. With eMoney, all funds are held in one central bank account, with balances being reflected on an electronic ledger. More info on this can be found in this blog, but let’s look at how this works in practice.

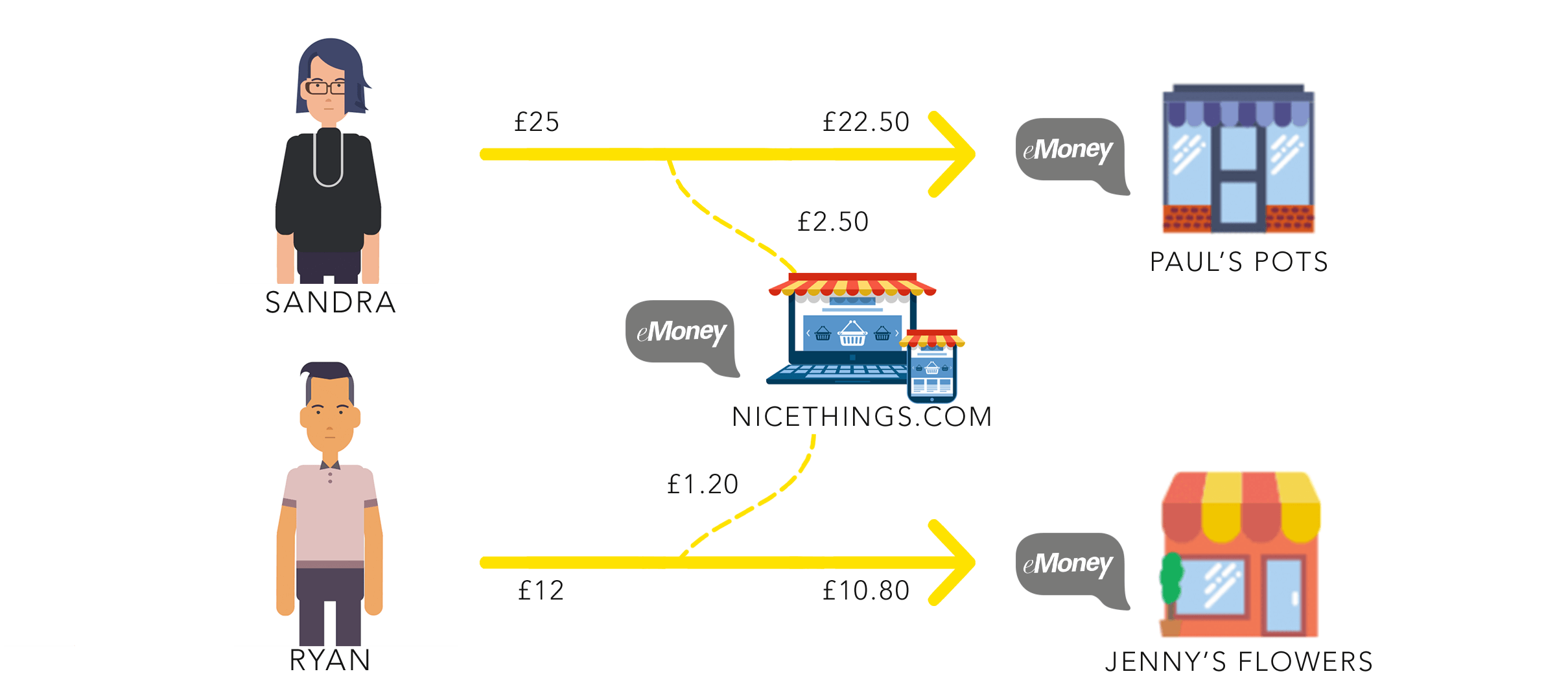

You have a marketplace called ‘Nicethings.com’. A buyer goes on to your marketplace and decides to buy a pot from a particular seller (Paul’s Pots). The pot costs £25 and the buyer is happy with the price. You as the marketplace charge sellers 10% on any sales they make.

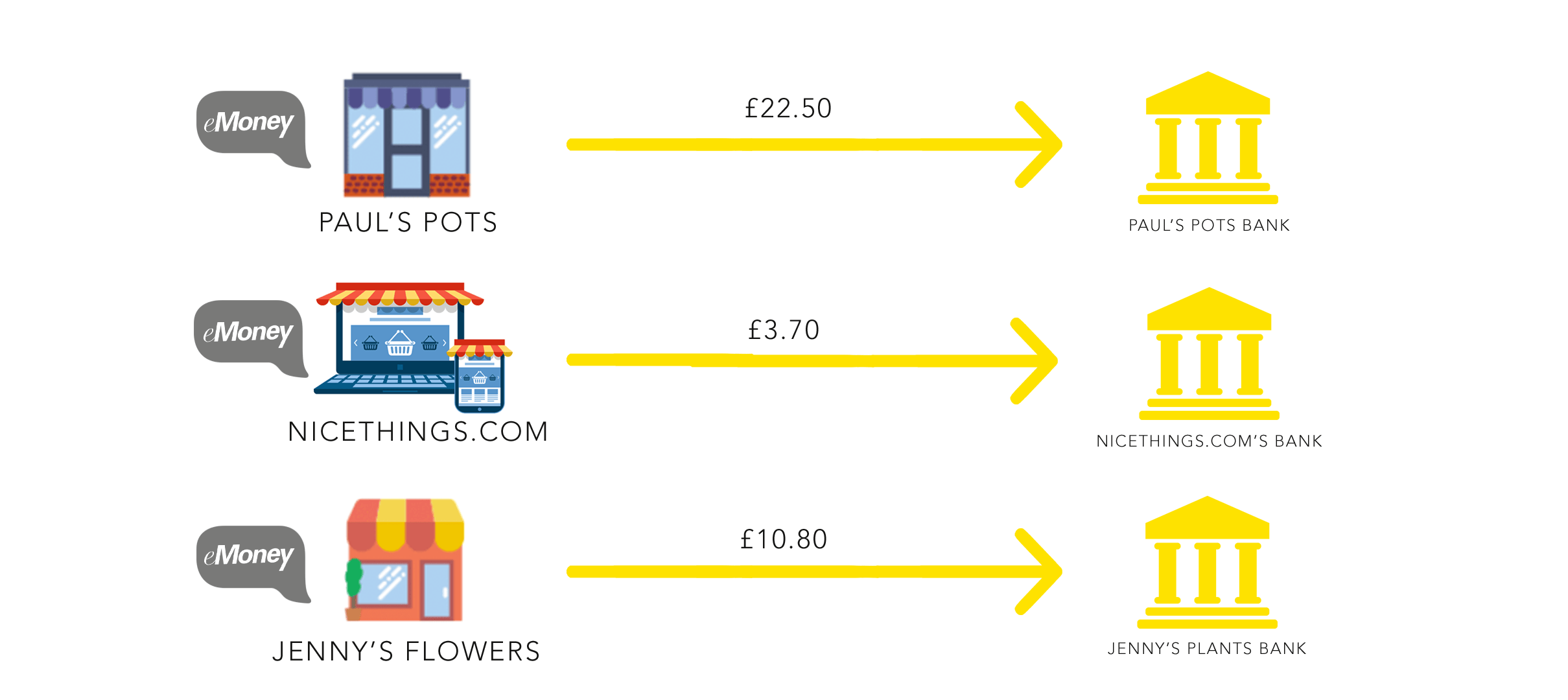

The buyer pays online by card, as with any online purchase. That £25 then goes to the central account. Due to the commission charge, £22.50 is displayed on the seller’s eMoney balance (Paul’s Pots), and £2.50 is displayed on your eMoney balance as the platform. When the seller chooses to withdraw their £22.50, it is debited from the central account and transferred to their bank account (again, automatically). When you as the platform choose to withdraw, the exact same thing happens.

The diagrams below explain how this payment flow looks. It works the exact same way for all merchants on your marketplace.

As you can see, this is a far easier and cleaner approach to platform payments. If a platform decides to use eMoney, they must either become regulated as an eMoney institution (a high-cost process which will take at least 6 months or possibly even years), or partner with a firm that is.

Paybase was built to serve these businesses. The Paybase solution not only splits payments however a client wishes, but ensures they are covered in terms of all current and future regulatory standards.

So, whilst there are various ways in which payments can work for platform businesses, using eMoney is by far the most efficient option. If an eMoney solution is what your business needs, get in touch with us today by clicking here.