‘Tis the Season to be Vigilant

Nov 29, 2017, by Danielle Herndon and Dan Whale

Fraud Protection

Payments

Security

As fraud rates rocket during the holiday period, we look at the best ways of ensuring that you don’t fall victim to fraudsters - and what steps to take if you do.

We’re entering that time of year when the emotional adverts begin, stores are putting up tinsel and offices throughout the country are arguing about when it’s acceptable to play Christmas songs.

It’s not seen as particularly festive to talk about financial crime, but the fact of the matter is that fraud increases drastically between the end of November and New Years Eve. According to ACI Worldwide, global fraud attempts spike by 31% during the holiday period as fraudsters attempt to hide their activity in the high volume of traffic that hits online shopping sites.

But of course, fraud occurs all throughout the year. In fact, fraud and cybercrime now represent a staggering 50% of all crime reported in England and Wales. The rise in cybercrime is an issue of such importance that Barclays launched a £10m anti-fraud campaign this year, featuring TV adverts demonstrating some of the most common techniques used by fraudsters.

It should be noted that this is not something that is only affecting a small group of people who are careless with their details - 25% of people have experienced fraud/cybercrime in the past 3 years. So what are the best ways to stay safe this Christmas?

How to prevent

You should always exercise caution when any person, site or service asks for your bank/card information. One of the most common methods of fraud is for a scammer to call a victim posing as an employee of their bank/utility company, usually requesting card details to ‘prevent further payments’. For this type of fraud, all that can be advised is general vigilance. However, there are more practical steps you can take to decrease the possibility of being targeted by scammers.

Secure Websites: It is important that you only enter your sensitive information on sites that are required to protect your payment data. Look for professional looking websites that have a privacy policy. Any firm that takes payments should also work with a regulated payment institution that is required to store your sensitive payment information in a secure manner.

Personal information security: In the age of social media, personal information is far more accessible than it once was. In order to apply for credit cards, loans and mobile phones, all that is needed is a name, date of birth and address. The date of birth is a particularly crucial part of identification as it's the only detail that never changes. Yet it’s also one of the easiest to find.

Even if your date of birth is not linked to your social media, a “Happy 21st! Hope you have a great day!’ message is not rare to see and gives the scammer all that they need. Furthermore, Equifax revealed in September 2017 that 400,000 UK citizens had their name, date of birth, email address and telephone number potentially accessible due to a “process failure”.

With this information so readily available, it is increasingly important to keep sensitive information as protected as possible. The safest course of action is to keep your profile private and not feature your date of birth.

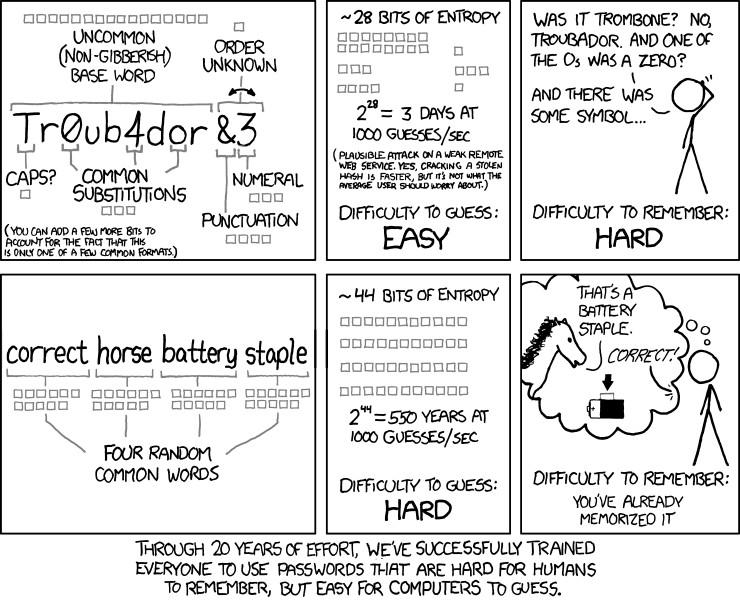

Password security: According to research, among the most popular passwords are ‘password’ and ‘123456’, and a 2016 report by Verizon revealed that “63% of confirmed data breaches involved leveraging weak, stolen or default passwords”. Even if the password is not to your internet banking, your emails and even social media profiles (as aforementioned) can reveal private information about you that fraudsters can use. It is therefore important that all of your passwords are secure.

Whilst you may think your password is rock solid as it includes a capital letter, number and special character, the modern school of thought on the matter is that a series of words can actually be far safer. A series of words is not only harder to crack, but easier to remember, removing the need to keep a stash of passwords written down.

Software security: There is free software available that you can use to ensure you’re being as safe as you can be online. HTTPS Everywhere is a plug-in for your browser that forces websites to use an HTTPS connection, as opposed to an HTTP connection, if they have it. This prevents you from being directed to fake or untrustworthy sites and making purchases there.

Exceptional Deals: Fraud on online auction sites increases during the holiday period due to consumers’ desire to find the best and most affordable prices. Unfortunately, fraudsters are aware of this and advance fee fraud - fraud where an individual submits part or full payment up front ahead of the receipt of a good or service - increases significantly during this time. In fact, the BBC reports that this type of fraud on online auction sites accounts for 65% of the crimes during Christmas. To stay safe, make sure you avoid using direct bank transfer, only use reputable websites, and remember that if something seems too inexpensive to be true, think twice before buying.

How to react

If you believe you have been a victim of fraud or cyber crime there are a number of steps you can take.

Firstly, if the fraud involves credit cards, debit cards, cheques or online banking, you should contact your bank immediately. In most situations the bank will be able to get your money back - they can only deny your claim if they can prove that you were ‘grossly negligent’. Examples of gross negligence go beyond ordinary carelessness - for example telling someone else your PIN code or leaving it written down on your desk at work.

If you feel that your case has been unfairly classed as gross negligence, you still have a chance of getting your money back; you can complain to the Financial Ombudsman. Not only this, but a model is currently being drawn up by the UK Payments Systems Regulator that would make banks reimburse victims of ‘push payment fraud’ - scams that trick a user into instructing their bank to transfer money to a fraudster (as shown in the video posted above).

Secondly, if you have a digital wallet that is hacked, you should not only contact your bank but the payment institution that it is linked to. By contacting the institution immediately they can take all necessary measures to halt any fraudulent behaviour and track where your money has gone.

Finally you can contact Action Fraud for other fraud related concerns, which will investigate your case and involve the police if it deems it necessary. In short, if you fall victim to fraud, don’t panic. As long you were protective of your details, you should be able to get your money back.

Paybase fraud protection

With security as our most important focus, we offer the highest standard of fraud and anti-money laundering protection, to both our partners and their customers, across the entire payment process. We are fully PCI-DSS compliant, and keep card information secure and encrypted to a higher standard than is required. We provide AVS checks and IP tracking, designed to combat the issue of personal information being so readily available.

However, what we can deliver goes further than this. Due to our innovative Logic Engine, firms that partner with Paybase will be able to customise their own anti-fraud framework to fully suit their needs.

For example, if you are a firm usually receiving small volume transactions, you can receive an alert any time a transaction is made over a certain amount. Alternatively, accounts can be locked immediately after certain behaviour to limit any suspicious activity taking place. We at Paybase offer in-house training and guidance so that businesses can create a curated payments system which leaves them fully protected, but not heavy-handed, in the face of fraudulent activity.

If you would like to know more about how we can protect your company from fraud with our end-to-end payment solution, please contact us!